Here is all you really need to know about why Puerto Rico is without power and why Whitefish got the contract to restore it.

Government is not your friend.

-------------------------------------------------------

The Puerto Rico Electric Power Authority (PREPA) —Spanish: Autoridad de Energía Eléctrica(AEE)— is an electric power company and the government-owned corporation of Puerto Ricoresponsible for electricity generation, power distribution, and power transmission on the island.[1]PREPA is the only entity authorized to conduct such business in Puerto Rico, making it a government monopoly. The authority is ruled by a board of directors appointed by the governor with the advice and consent of the Senate. Since 2014, PREPA is subject to the Puerto Rico Energy Commission, another government agency whose board of directors is also appointed by the governor.

Concerning the Whitefish contract:

. . . . the contract, which Whitefish signed with the government-owned PREPA states that “In no event shall [government bodies] have the right to audit or review the cost and profit elements.” That gave Whitefish wide of discretion and privacy over how it used $300 million in American taxpayer money.

The contract also waived “any claim against Contractor related to delayed completion of the work,” which means the government couldn’t do much if Whitefish dragged out its work . . .

Monday, October 30, 2017

Sunday, October 29, 2017

It is Governments that create poverty

Here is an article by Chelsea Follett from HumanProgress.com.

CF is on target.

Unfortunately, most people continue to think that Government helps, e.g., the clamor for more government interference and even socialism.

-------------------------------------------------

Earlier this month, the United Nations urged the world to celebrate the International Day for the Eradication of Poverty, advertising it on social media using the hashtag #EndPoverty. The UN noted the incredible progress on the issue:

Countries have taken action to end poverty… The Government of Tanzania, for example, started a massive overhaul of its current national programme, the Tanzania Productive Social Safety Nets, to reach people living below the food poverty line.

It is an accidentally instructive example. Tanzania has made impressive progress against poverty, but that is not because of increased government spending on food for the poor. In fact, Tanzania’s government is today far less redistributionist than in the past — and those past policies of redistribution led to near-starvation for the poorest Tanzanians.

In 2011, the most recent year for which the World Bank has data, just under half of Tanzanians lived in extreme poverty. That figure was 86 per cent in 2000.

The real cause of that reduction is pretty straightforward: economic freedom. Tanzania has gradually dismantled the socialist or “ujamaa” economic policies enacted by the dictator Julius Nyerere, since he stepped down in 1985. Nyerere was widely praised by leftist intellectuals in developed countries for his sincere belief in socialism, relatively low level of corruption, and not intentionally slaughtering his own people like so many other dictators.

But Nyerere instituted policies that, according to Dr. John Shao, resulted in intense food shortages, a collapse of agricultural and industrial production, deteriorating transportation infrastructure, economic crisis and “general distress of the population” by the 1980s. Nyerere also banned opposing political parties to consolidate his authority and prevent debate about his ruinous policies.

Post-Nyerere, Tanzania managed to speed up its economic growth rate by removing price controls, liberalizing trade, and freeing its people to engage in private enterprise.

The UN’s attribution of progress to government programs, and its insistence on the importance of foreign aid to development, is as worrying as it is unsurprising.

Nyerere was able to hold onto power for so long despite his disastrous programs thanks to billions of dollars of aid money. As my colleague Doug Bandow put it, “The World Bank, demonstrating that it lacked both a conscience and common sense, directly underwrote his brutal ujamaa scheme.”

Not only is government aid ineffective compared to market-led development, but aid programs often ignore the property rights of the poor and the need for institutional reform. Other examples of dictators who received aid money include Idi Amin of Uganda, Mengistu Haile Mariam of Ethiopia, Mobutu Sese Seko of Zaire (now the Democratic Republic of the Congo) and even the infamously brutal Pol Pot of Cambodia.

The money often props up authoritarian regimes while they pursue destructive policies such as stealing their citizens’ farmland through nationalization. That was the case in Tanzania, which received billions of dollars in foreign aid while its socialist government nationalized hundreds of farms — slashing agricultural production and leading to the aforementioned massive food shortages. The store shelves were empty, and people waited for rations of food.

“When I first came to Tanzania in the 1980s, we used to have whole wards of kids very debilitated with malnutrition, some too far gone to survive,” recalls an aid worker for the World Food Programme, the food-assistance branch of the United Nations, “now there will only be up to one or two at any time, and we would usually find a social cause, such as an alcoholic father, or being orphaned, or inheriting HIV.” The page containing that quote goes on to claim that the U.N. food programme “made a difference”, but the reason far fewer children resort to using the food programme today compared to the 1980s is conspicuously absent.

Reducing trade barriers is far more effective at improving the quality of life for those in poor areas of the world than sending aid or technocrats to help design government programs. To get serious about eradicating poverty, countries should pursue policies of economic freedom. Because, ultimately, countries don’t fight poverty. Individuals free of excessive regulations and able to participate in global trade do.

CF is on target.

Unfortunately, most people continue to think that Government helps, e.g., the clamor for more government interference and even socialism.

-------------------------------------------------

Earlier this month, the United Nations urged the world to celebrate the International Day for the Eradication of Poverty, advertising it on social media using the hashtag #EndPoverty. The UN noted the incredible progress on the issue:

Poverty has declined globally, from 1.7 billion people in 1999 to 767 million in 2013, a drop in the global poverty rate from 28 percent in 1999 to 11 per cent in 2013. The most significant progress was seen in Eastern and South-Eastern Asia, where the rate declined from 35 per cent in 1999 to 3 per cent in 2013.Unfortunately, the UN seems to misunderstand the source of that progress. It argues that government action and top-down technocrat-led programs are to thank for poverty’s remarkable decline. The UN statement continues:

Countries have taken action to end poverty… The Government of Tanzania, for example, started a massive overhaul of its current national programme, the Tanzania Productive Social Safety Nets, to reach people living below the food poverty line.

It is an accidentally instructive example. Tanzania has made impressive progress against poverty, but that is not because of increased government spending on food for the poor. In fact, Tanzania’s government is today far less redistributionist than in the past — and those past policies of redistribution led to near-starvation for the poorest Tanzanians.

In 2011, the most recent year for which the World Bank has data, just under half of Tanzanians lived in extreme poverty. That figure was 86 per cent in 2000.

The real cause of that reduction is pretty straightforward: economic freedom. Tanzania has gradually dismantled the socialist or “ujamaa” economic policies enacted by the dictator Julius Nyerere, since he stepped down in 1985. Nyerere was widely praised by leftist intellectuals in developed countries for his sincere belief in socialism, relatively low level of corruption, and not intentionally slaughtering his own people like so many other dictators.

But Nyerere instituted policies that, according to Dr. John Shao, resulted in intense food shortages, a collapse of agricultural and industrial production, deteriorating transportation infrastructure, economic crisis and “general distress of the population” by the 1980s. Nyerere also banned opposing political parties to consolidate his authority and prevent debate about his ruinous policies.

Post-Nyerere, Tanzania managed to speed up its economic growth rate by removing price controls, liberalizing trade, and freeing its people to engage in private enterprise.

The UN’s attribution of progress to government programs, and its insistence on the importance of foreign aid to development, is as worrying as it is unsurprising.

Nyerere was able to hold onto power for so long despite his disastrous programs thanks to billions of dollars of aid money. As my colleague Doug Bandow put it, “The World Bank, demonstrating that it lacked both a conscience and common sense, directly underwrote his brutal ujamaa scheme.”

Not only is government aid ineffective compared to market-led development, but aid programs often ignore the property rights of the poor and the need for institutional reform. Other examples of dictators who received aid money include Idi Amin of Uganda, Mengistu Haile Mariam of Ethiopia, Mobutu Sese Seko of Zaire (now the Democratic Republic of the Congo) and even the infamously brutal Pol Pot of Cambodia.

“When I first came to Tanzania in the 1980s, we used to have whole wards of kids very debilitated with malnutrition, some too far gone to survive,” recalls an aid worker for the World Food Programme, the food-assistance branch of the United Nations, “now there will only be up to one or two at any time, and we would usually find a social cause, such as an alcoholic father, or being orphaned, or inheriting HIV.” The page containing that quote goes on to claim that the U.N. food programme “made a difference”, but the reason far fewer children resort to using the food programme today compared to the 1980s is conspicuously absent.

Reducing trade barriers is far more effective at improving the quality of life for those in poor areas of the world than sending aid or technocrats to help design government programs. To get serious about eradicating poverty, countries should pursue policies of economic freedom. Because, ultimately, countries don’t fight poverty. Individuals free of excessive regulations and able to participate in global trade do.

Trade

Here is Richard Epstein's article "The Looming NAFTA Disaster" at the Hoover Institution.

It is a fact that free trade has the potential to make everyone better off. It also is a fact that the previous sentence does not imply that free trade will make everyone better off. Too many people ignore the latter fact. That contributed to Trump gaining the Presidency.

My comments are in italics.

----------------------------------------------------

The North America Free Trade Agreement (NAFTA) among Canada, Mexico, and the United States was put into place in November 1993 with the staunch support of the Clinton administration. A sweeping agreement that lifted major trade barriers among these three nations, NAFTA had its share of problems when it was implemented, including the dislocation of some workers.

It is a fact that free trade has the potential to make everyone better off. It also is a fact that the previous sentence does not imply that free trade will make everyone better off. Too many people ignore the latter fact. That contributed to Trump gaining the Presidency.

My comments are in italics.

----------------------------------------------------

The North America Free Trade Agreement (NAFTA) among Canada, Mexico, and the United States was put into place in November 1993 with the staunch support of the Clinton administration. A sweeping agreement that lifted major trade barriers among these three nations, NAFTA had its share of problems when it was implemented, including the dislocation of some workers.

This is no different than dislocation of workers from competition and new technologies domestically. If there is a net gain that makes the dislocation worthwhile domestically, then why not recognize the same internationally?

But the mutual gains from free trade dwarfed any losses associated with the agreement.

Not everyone gained. This is the kind of overstatement that breeds widespread distrust. If there was a system in place to assure that everyone gained, perhaps no one would object.

Now, over twenty years later, NAFTA needs to be updated to take into account new technologies, such as those associated with the digital economy.

Free trade is free trade is free trade . . . . If the agreement needs to be updated, then it was incorrectly characterized as free trade in the first place. And if that is true, some people benefited unfairly at others' expense. More reason for widespread distrust.

As the agreement gets renegotiated, all three parties should make as few changes as possible to bring the agreement up to date without altering its fundamental structure. But that might not happen. Each of the three signatory nations has adopted a tough bargaining position that could result in a breakdown of the treaty, which would be the greatest trade disaster in recent years.

What is to be bargained if it is free trade? Simple agreement: No government interference or involvement anywhere.

The American public seems to be mixed on free trade. On the one hand, during the recent presidential campaign, much of the electorate, including many Republicans, turned against the Trans-Pacific Partnership (TPP), a free trade deal among Pacific Rim nations, while still announcing their support for free trade in the abstract.

The American public seems to be mixed on free trade. On the one hand, during the recent presidential campaign, much of the electorate, including many Republicans, turned against the Trans-Pacific Partnership (TPP), a free trade deal among Pacific Rim nations, while still announcing their support for free trade in the abstract.

The problem is that "Free Trade" agreements are not free trade agreements.

But upon taking office, Donald Trump proudly but foolishly withdrew from the TPP, and since that time has taken every opportunity to denounce free trade and to express his frustration with NAFTA. Today, his demands on NAFTA, as communicated through his trade representative Robert Lighthizer, have effectively deadlocked negotiations going forward.

No doubt these agreements benefit the average citizen of all participating countries - and in that sense "foolish" is justified. However, nobody is average - so perhaps those who advocate these agreements and ignore those who lose in the bargain should be characterized as scam artists.

Trump’s position is particularly galling because of the total discontinuity between his approach on domestic and foreign economic issues. Just last week, I wrote a column that strongly defended Trump’s efforts to introduce competition and choice into the health care market.

Trump’s position is particularly galling because of the total discontinuity between his approach on domestic and foreign economic issues. Just last week, I wrote a column that strongly defended Trump’s efforts to introduce competition and choice into the health care market.

Here, too, more competition and choice have the potential to make everyone better off - but will not. And, here, too, the losers will be left to fend for themselves.

Saturday, October 28, 2017

The Ninth Circuit Court fails at law and logic

Here is an example of how the Ninth Circuit Court makes law, rather than interprets it, and proves itself illogical.

Here is the Summary of Argument from the Amicus Curiae brief filed by the Crime Prevention Research Center with the United States Supreme Court.

This Court’s decision in District of Columbia v. Heller, 554 U.S. 570 (2008) established that the Second Amendment safeguards an individual right to keep and bear arms. The majority concluded that the outright ban on handguns at issue in that case failed constitutional muster under any level of possible scrutiny, but the decision left for future evaluation whether other gun regulations would be subject to strict scrutiny or intermediate scrutiny (or some other scrutiny more rigorous than the rationale basis test), and how those levels of scrutiny would be applied. Id., 626-27, 128 S.Ct. 2783.

After nearly ten years, however, the lower courts have struggled to apply the Heller decision. Most of the circuits have adopted a form of intermediate scrutiny for regulations that do not include a wholesale ban on a type of firearm. But even then, the standards applied by the lower courts vary widely. Some circuits, specifically the Second Circuit and the Ninth Circuit, have demonstrated ongoing hostility to the core concept of Heller that the right to bear arms is an important individual right and, while purporting to apply a level of intermediate scrutiny borrowed from other areas of constitutional jurisprudence – primarily free speech cases – have weakened their constitutional jurisprudence to approve restrictions on Second Amendment rights that would not be allowed for other rights.

As a research and education organization, CPRC is concerned by decisions, such as the Ninth Circuit’s decision here, that pay lip service to a 3 heightened level of scrutiny for gun regulations, but that end up wholly ignoring the evidentiary standards and academic research that inform the appropriate breadth of other constitutional rights.

Here, the Ninth Circuit reversed the evidentiary findings of the trial court and supplanted the evidence that the trial court received and weighed with its own non-empirical views of what it thought was reasonable. The trial court received and evaluated numerous studies that were offered at trial and found, as the trier of fact and with full support in the record, that none of the studies provided even a scintilla of evidence that a gun purchase waiting period beyond the time required to complete a background check enhanced safety or reduced gun violence for those who already owned a gun. This evidence-free approach is inconsistent with other circuits (excepting in part the Second Circuit) and with the constitutional evaluation of other constitutional rights.

Also, by replacing the weighing of evidence with its own view of what was reasonable, the Ninth Circuit effectively nullified the burden of proof that is supposed to apply to any form of heightened scrutiny, watering down the intermediate scrutiny test to little more than a rational basis review with a different name.

Similarly, an appropriate intermediate scrutiny analysis requires that a law not burden more of the right “than is reasonably necessary.” United States v. Marzzarella, 614 F.3d 85, 98 (3d Cir. 2010). Accordingly, under an intermediate scrutiny review, a 4 court should consider reasonable, but less restrictive, alternatives. And in the context of First Amendment rights, the Ninth Circuit agrees. Menotti v. City of Seattle, 409 F.3d 1113, 1171 (9th Cir. 2005).

The Ninth Circuit here, and the Second Circuit in New York State Rifle and Pistol Ass’n Inc. v. Cuomo, 804 F.3d 242, 255 (2d Cir. 2015), however, have determined that this protection need not apply to Second Amendment challenges. Rather, laws that infringe upon rights guaranteed by the Second Amendment are upheld in the Ninth Circuit and the Second Circuit if they promote safety, even if narrower laws would provide the same level of safety.

This case presents an opportunity to ensure uniformity among the circuits and respect for the core principle that the right to keep and bear arms is an important individual right deserving of the same rigorous protections as other individual rights recognized by the United States Constitution.

Here is a beautiful example of the Ninth Circuit Court's lack of logic.

Indeed, the Ninth Circuit only endeavored to look at one piece of the trial level evidence that the trial court had concluded was unhelpful to the government. That one piece was a pair of studies reviewed by the trial court that showed a slight correlation overall between waiting periods and a reduction in immediate post-purchase acts of violence or suicide (at least for the elderly). The trial court correctly noted that the study provided no information on whether the reduction in impulsive post-purchase acts of violence or suicide applied to those who already had a gun at hand.

The Ninth Circuit decided that its own rationalization was just as good as actual evidence, writing that “the studies [finding a reduction in postpurchase violence or suicide with a waiting period] related to all purchasers.” And since the class of purchasers who already owned a gun was part of the class of “all purchasers,” the Ninth Circuit reasoned, then it was only “common sense” that the reduction in violence and suicide found by the study applied to prior gun owners too. Id., 843 F.3d at 828.

The Ninth Circuit blatantly replaced evidence with its own “common sense.” And in the process, it fell into a form of a common logical error known as the Fallacy of Division.

The Fallacy of Division is committed when an argument is presented “[a]ssuming that what is true of a whole is therefore true of each of the parts of that whole.” T. Edward Damer, Attacking Faulty Reasoning: A Practical Guide to Fallacy-Free Arguments 151 (7th Edition 2012). Professor Damer provides as an example the argument that because a Boeing 747 can fly unaided across the ocean, and because a Boeing 747 has jet engines, each jet engine can fly unaided across the ocean.

Applied here, just because the whole of all gun owners may have the characteristic of benefitting from a waiting period does not mean that all subsets of gun owners likewise benefit. What the Ninth Circuit saw as common sense was actually a common logical fallacy. And in such mistakes we see the need to rely on evidence, and not rational speculation.

Here is the Summary of Argument from the Amicus Curiae brief filed by the Crime Prevention Research Center with the United States Supreme Court.

This Court’s decision in District of Columbia v. Heller, 554 U.S. 570 (2008) established that the Second Amendment safeguards an individual right to keep and bear arms. The majority concluded that the outright ban on handguns at issue in that case failed constitutional muster under any level of possible scrutiny, but the decision left for future evaluation whether other gun regulations would be subject to strict scrutiny or intermediate scrutiny (or some other scrutiny more rigorous than the rationale basis test), and how those levels of scrutiny would be applied. Id., 626-27, 128 S.Ct. 2783.

After nearly ten years, however, the lower courts have struggled to apply the Heller decision. Most of the circuits have adopted a form of intermediate scrutiny for regulations that do not include a wholesale ban on a type of firearm. But even then, the standards applied by the lower courts vary widely. Some circuits, specifically the Second Circuit and the Ninth Circuit, have demonstrated ongoing hostility to the core concept of Heller that the right to bear arms is an important individual right and, while purporting to apply a level of intermediate scrutiny borrowed from other areas of constitutional jurisprudence – primarily free speech cases – have weakened their constitutional jurisprudence to approve restrictions on Second Amendment rights that would not be allowed for other rights.

As a research and education organization, CPRC is concerned by decisions, such as the Ninth Circuit’s decision here, that pay lip service to a 3 heightened level of scrutiny for gun regulations, but that end up wholly ignoring the evidentiary standards and academic research that inform the appropriate breadth of other constitutional rights.

Here, the Ninth Circuit reversed the evidentiary findings of the trial court and supplanted the evidence that the trial court received and weighed with its own non-empirical views of what it thought was reasonable. The trial court received and evaluated numerous studies that were offered at trial and found, as the trier of fact and with full support in the record, that none of the studies provided even a scintilla of evidence that a gun purchase waiting period beyond the time required to complete a background check enhanced safety or reduced gun violence for those who already owned a gun. This evidence-free approach is inconsistent with other circuits (excepting in part the Second Circuit) and with the constitutional evaluation of other constitutional rights.

Also, by replacing the weighing of evidence with its own view of what was reasonable, the Ninth Circuit effectively nullified the burden of proof that is supposed to apply to any form of heightened scrutiny, watering down the intermediate scrutiny test to little more than a rational basis review with a different name.

Similarly, an appropriate intermediate scrutiny analysis requires that a law not burden more of the right “than is reasonably necessary.” United States v. Marzzarella, 614 F.3d 85, 98 (3d Cir. 2010). Accordingly, under an intermediate scrutiny review, a 4 court should consider reasonable, but less restrictive, alternatives. And in the context of First Amendment rights, the Ninth Circuit agrees. Menotti v. City of Seattle, 409 F.3d 1113, 1171 (9th Cir. 2005).

The Ninth Circuit here, and the Second Circuit in New York State Rifle and Pistol Ass’n Inc. v. Cuomo, 804 F.3d 242, 255 (2d Cir. 2015), however, have determined that this protection need not apply to Second Amendment challenges. Rather, laws that infringe upon rights guaranteed by the Second Amendment are upheld in the Ninth Circuit and the Second Circuit if they promote safety, even if narrower laws would provide the same level of safety.

This case presents an opportunity to ensure uniformity among the circuits and respect for the core principle that the right to keep and bear arms is an important individual right deserving of the same rigorous protections as other individual rights recognized by the United States Constitution.

Here is a beautiful example of the Ninth Circuit Court's lack of logic.

Indeed, the Ninth Circuit only endeavored to look at one piece of the trial level evidence that the trial court had concluded was unhelpful to the government. That one piece was a pair of studies reviewed by the trial court that showed a slight correlation overall between waiting periods and a reduction in immediate post-purchase acts of violence or suicide (at least for the elderly). The trial court correctly noted that the study provided no information on whether the reduction in impulsive post-purchase acts of violence or suicide applied to those who already had a gun at hand.

The Ninth Circuit decided that its own rationalization was just as good as actual evidence, writing that “the studies [finding a reduction in postpurchase violence or suicide with a waiting period] related to all purchasers.” And since the class of purchasers who already owned a gun was part of the class of “all purchasers,” the Ninth Circuit reasoned, then it was only “common sense” that the reduction in violence and suicide found by the study applied to prior gun owners too. Id., 843 F.3d at 828.

The Ninth Circuit blatantly replaced evidence with its own “common sense.” And in the process, it fell into a form of a common logical error known as the Fallacy of Division.

The Fallacy of Division is committed when an argument is presented “[a]ssuming that what is true of a whole is therefore true of each of the parts of that whole.” T. Edward Damer, Attacking Faulty Reasoning: A Practical Guide to Fallacy-Free Arguments 151 (7th Edition 2012). Professor Damer provides as an example the argument that because a Boeing 747 can fly unaided across the ocean, and because a Boeing 747 has jet engines, each jet engine can fly unaided across the ocean.

Applied here, just because the whole of all gun owners may have the characteristic of benefitting from a waiting period does not mean that all subsets of gun owners likewise benefit. What the Ninth Circuit saw as common sense was actually a common logical fallacy. And in such mistakes we see the need to rely on evidence, and not rational speculation.

Friday, October 27, 2017

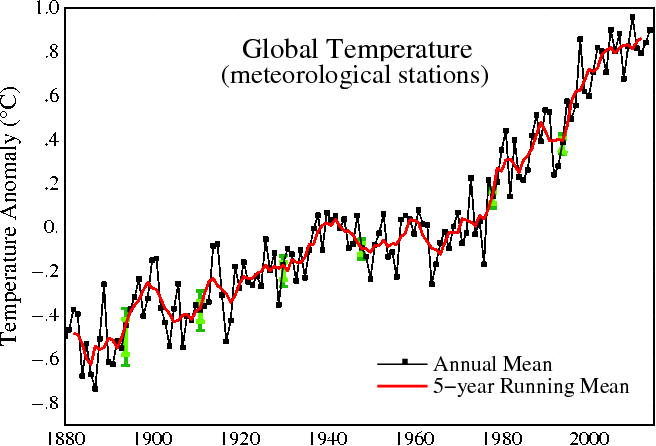

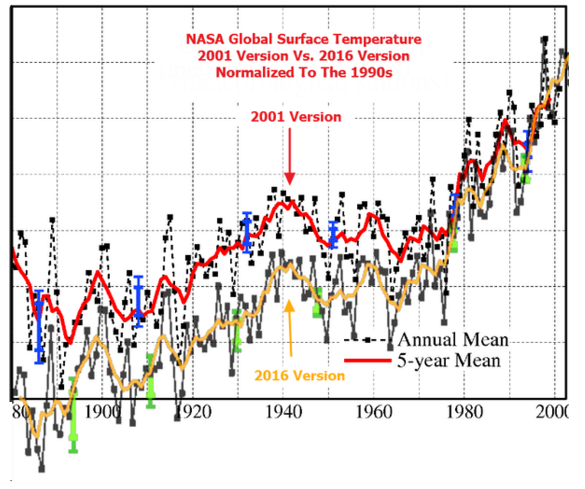

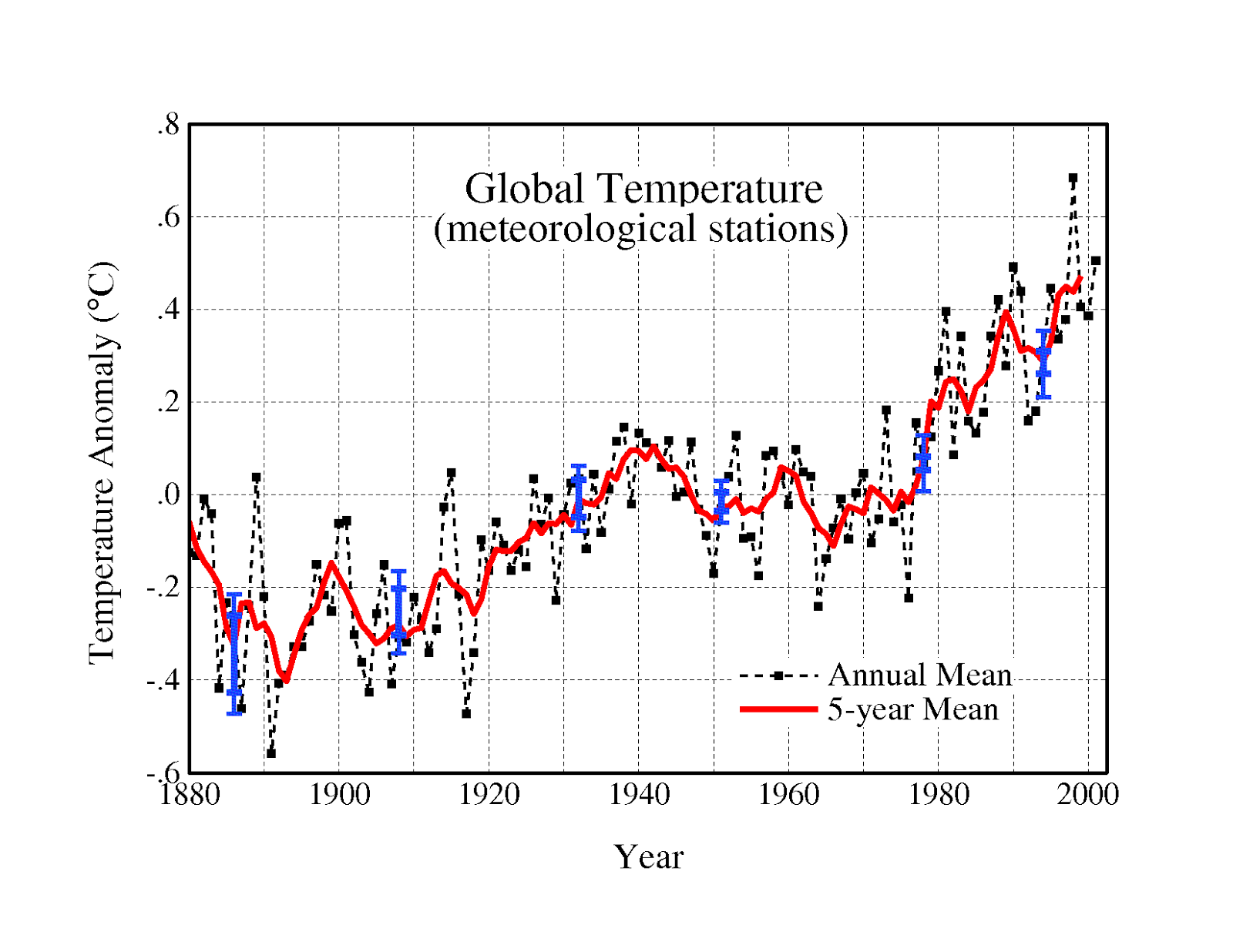

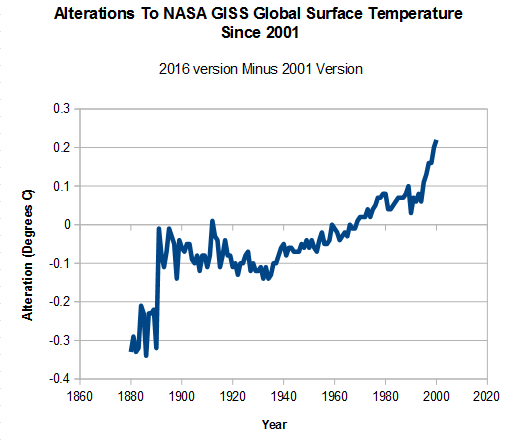

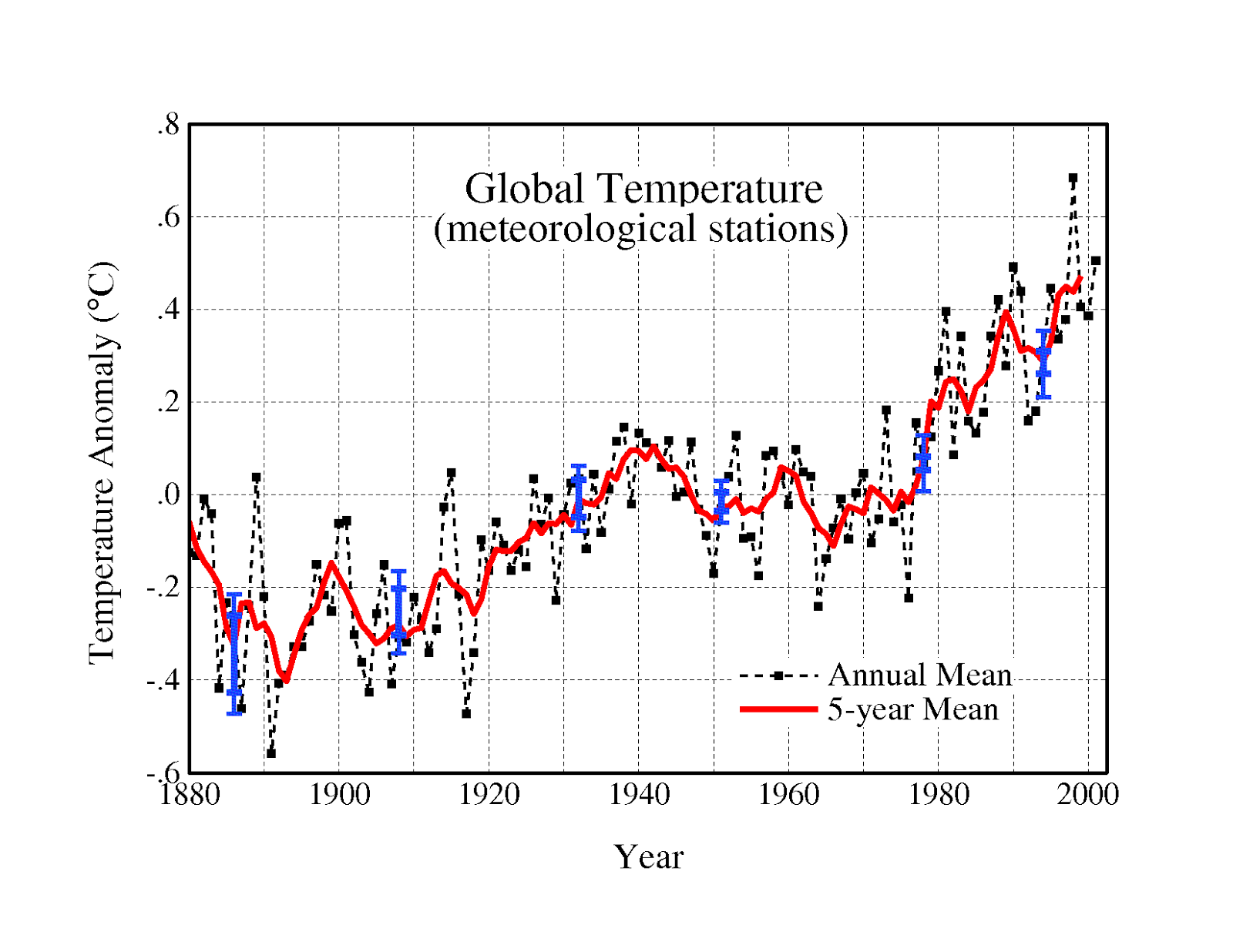

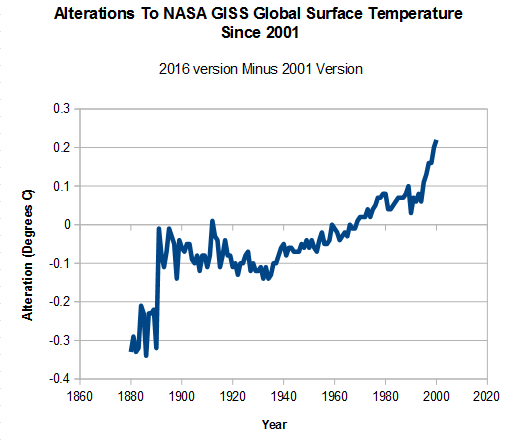

The Validity of EPA's CO2 Endangerment Finding

Food for thought about what you have been told about climate change.

Here is the link.

Here is the conclusion.

--------------------------------------------

Given the potential significance of this research, it is appropriate to question everything about it. Questioning everything is fair game from 1) the selection of the particular 13 temperature time series by one of the authors for this analysis to the 2) econometric parameter estimation methods utilized to 3) the actual models estimated. On all three, the authors have attempted to be completely open.

Here is the link.

Here is the conclusion.

--------------------------------------------

Given the potential significance of this research, it is appropriate to question everything about it. Questioning everything is fair game from 1) the selection of the particular 13 temperature time series by one of the authors for this analysis to the 2) econometric parameter estimation methods utilized to 3) the actual models estimated. On all three, the authors have attempted to be completely open.

Regarding the model used for ENSO adjustment, recall that the exact same linear functional form and 3 MEI-related variables were used, except that the 1977 Pacific Shift variable is dropped for the Satellite data modeling since its history begins in 1979.

The econometric modeling process output was remarkable in that, for all 13 temperature time series analyzed, the results were invariably the same: The identical (3 or 2 MEI-related variables as appropriate) model worked very well for all 13 time series:

1.) All parameter estimates had the correct signs and with high, statistically significant t Statistics; except that the MEI coefficients for U.S. and Global temperatures were positive, but not statistically significant.

2.) However, it was noted a priori that MEI would be expected to have less impact outside the tropics.

3.) Model R Bar Squares were all higher than relevant Naive forecasting models and high for such empirical work.

The 13 time series analyzed constituted a robust test set in that they were produced by many different entities using different technologies involving Surface, Buoy, Balloon and Satellite temperature measurement.

Removing the ENSO impacts using the same MEI-based model resulted in 13 ENSO-adjusted temperature time series each having a flat trend.

These analysis results would appear to leave very, very little doubt that EPA’s claim of a Tropical Hot Spot, caused by rising atmospheric CO2 levels, simply does not exist in the real world. Also critically important, even on an all-otherthings-equal basis, this analysis failed to find that the steadily rising Atmospheric CO2 Concentrations have had a statistically significant impact on any of the 13 temperature time series analyzed.

Thus, the analysis results invalidate each of the Three Lines of Evidence in its CO2 Endangerment Finding. Once EPA’s THS assumption is invalidated, it is obvious why the climate models they claim can be relied upon, are also invalid. And, these results clearly demonstrate--13 times in fact--that once just the ENSO impacts on temperature data are accounted for, there is no “record setting” warming to be concerned about. In fact, there is no ENSO-Adjusted Warming at all. These natural ENSO impacts involve both changes in solar activity and the 1977 Pacific Shift.

Moreover, on an all-other-things-equal basis, there is no statistically valid proof that past increases in Atmospheric CO2 Concentrations have caused the officially reported rising, even claimed record setting temperatures. To validate their claim will require mathematically credible, publically available, simultaneous equation parameter estimation work. Where is it?

Thursday, October 26, 2017

The Glyphosate Scandal

Here is Matt Ridley's column "The Glyphosate Scandal.

-----------------------------------------

Bad news is always more newsworthy than good. The widely reported finding that insect abundance is down by 75 per cent in Germany over 27 years was big news, while, for example, the finding in May that ocean acidification is a lesser threat to corals than had been thought caused barely a ripple. The study, published in the leading journal Nature, found that corals’ ability to make skeletons is “largely independent of changes in seawater carbonate chemistry, and hence ocean acidification”. But good news is no news.

And bad news is big news. The German insect study, in a pay-to-publish journal, may indeed be a cause for concern, but its findings should be treated with caution, my professional biologist friends tell me. It did not actually compare the same sites over time. Indeed most locations were only sampled once, and the scientists used mathematical models to extract a tentative trend from the inconsistent sampling.

Greens were quick to use the insect study to argue for a ban on the widely used herbicide glyphosate, also known as Roundup, despite no evidence for a connection. Glyphosate is made by Monsanto and sometimes used in conjunction with genetically modified crops.

Their campaign comes to a head this Wednesday in Brussels, where an expert committee of the European Commission will decide whether to ban glyphosate. The European parliament has already voted to do so, though its vote carries no weight. The committee will probably defer a decision until December, amid signs that the commission is getting fed up with the way French politicians in particular demand a ban in public then argue against it in private.

The entire case against glyphosate is one “monograph” from an obscure World Health Organisation body called the International Agency for Research on Cancer, which concluded that glyphosate might cause cancer at very high doses. It admitted that by the same criteria, sausages and sawdust should also be classified as carcinogens.

Indeed, pound for pound coffee is more carcinogenic than the herbicide, with the big difference that people pour coffee down their throats every day, which they don’t glyphosate. Ben & Jerry’s ice cream was recently found to contain glyphosate at a concentration of up to 1.23 parts per billion. At that rate a child would have to eat more than three tonnes of ice cream every day to reach the level at which any health effect could be measured.

The IARC finding is contradicted by the European Food Safety Authority as well as the key state safety agencies in America, Australia and elsewhere. The German Federal Institute for Risk Assessment looked at more than 3,000 studies and found no evidence of any risk to human beings at realistic doses: carcinogenic, mutagenic, neurotoxic or reproductive. Since glyphosate is a molecule that interferes with a metabolic process found in all plants but no animals, this is hardly surprising.

Meanwhile, glyphosate has huge environmental benefits for gardeners and farmers. In particular, it is an alternative to the destructive practice of ploughing to control weeds. It allows no-till agriculture, a burgeoning practice that preserves soil structure, moisture and carbon content, enabling worms and insects to flourish, improving drainage and biodiversity while allowing the high-yield farming that is essential if we are to feed humanity without cultivating more land. Organic farmers rely on frequent tillage.

-----------------------------------------

Bad news is always more newsworthy than good. The widely reported finding that insect abundance is down by 75 per cent in Germany over 27 years was big news, while, for example, the finding in May that ocean acidification is a lesser threat to corals than had been thought caused barely a ripple. The study, published in the leading journal Nature, found that corals’ ability to make skeletons is “largely independent of changes in seawater carbonate chemistry, and hence ocean acidification”. But good news is no news.

And bad news is big news. The German insect study, in a pay-to-publish journal, may indeed be a cause for concern, but its findings should be treated with caution, my professional biologist friends tell me. It did not actually compare the same sites over time. Indeed most locations were only sampled once, and the scientists used mathematical models to extract a tentative trend from the inconsistent sampling.

Greens were quick to use the insect study to argue for a ban on the widely used herbicide glyphosate, also known as Roundup, despite no evidence for a connection. Glyphosate is made by Monsanto and sometimes used in conjunction with genetically modified crops.

Their campaign comes to a head this Wednesday in Brussels, where an expert committee of the European Commission will decide whether to ban glyphosate. The European parliament has already voted to do so, though its vote carries no weight. The committee will probably defer a decision until December, amid signs that the commission is getting fed up with the way French politicians in particular demand a ban in public then argue against it in private.

The entire case against glyphosate is one “monograph” from an obscure World Health Organisation body called the International Agency for Research on Cancer, which concluded that glyphosate might cause cancer at very high doses. It admitted that by the same criteria, sausages and sawdust should also be classified as carcinogens.

Indeed, pound for pound coffee is more carcinogenic than the herbicide, with the big difference that people pour coffee down their throats every day, which they don’t glyphosate. Ben & Jerry’s ice cream was recently found to contain glyphosate at a concentration of up to 1.23 parts per billion. At that rate a child would have to eat more than three tonnes of ice cream every day to reach the level at which any health effect could be measured.

The IARC finding is contradicted by the European Food Safety Authority as well as the key state safety agencies in America, Australia and elsewhere. The German Federal Institute for Risk Assessment looked at more than 3,000 studies and found no evidence of any risk to human beings at realistic doses: carcinogenic, mutagenic, neurotoxic or reproductive. Since glyphosate is a molecule that interferes with a metabolic process found in all plants but no animals, this is hardly surprising.

Meanwhile, glyphosate has huge environmental benefits for gardeners and farmers. In particular, it is an alternative to the destructive practice of ploughing to control weeds. It allows no-till agriculture, a burgeoning practice that preserves soil structure, moisture and carbon content, enabling worms and insects to flourish, improving drainage and biodiversity while allowing the high-yield farming that is essential if we are to feed humanity without cultivating more land. Organic farmers rely on frequent tillage.

Descending to the null set of intelligence, and academic and political honesty

Here is Jonathan Turley's column. JT is on target but understates the issue.

-----------------------------------------

University of Illinois math professor Rochelle Gutierrez has triggered a national controversy over her recent anthology for math educators entitled, “Building Support for Scholarly Practices in Mathematics Methods.” Gutierrez suggests that mathematic tends to perpetuate white privilege that must be actively addressed in classrooms. For many, math is one subject that was viewed inherently objective and unbiased in its emphasis. Albert Einstein and others saw beauty in math. He stated “Pure mathematics is, in its way, the poetry of logical ideas.” Yet, Gutierrez appears to see the “politics that mathematics brings” and white privilege.

Gutierrez warns that “School mathematics curricula emphasizing terms like Pythagorean Theorem and pi perpetuate a perception that mathematics was largely developed by Greeks and other Europeans.” She adds “On many levels, mathematics itself operates as whiteness. Who gets credit for doing and developing mathematics, who is capable in mathematics, and who is seen as part of the mathematical community is generally viewed as white.”

Gutierrez raises these same views in her 2013 academic article entitled Why (Urban) Mathematics Teachers Need Political Knowledge in the Journal of Urban Mathematics Education. She wrote that “similar to whiteness, mathematics holds unearned privilege in society.” She emphasized that she was going beyond earlier writers who maintained that “mathematics education (emphasis added) operates as White institutional space. I am arguing that mathematics itself operates as whiteness.”

Gutierrez seeks to inject “political knowledge” into math classes to foster a “greater awareness of the unearned privilege that mathematics holds in society,.” She ties math to the ever-expanding notions of “microaggressions” and warns that many students “have experienced microaggressions from participating in math classrooms… [where people are] judged by whether they can reason abstractly.”

While I do not agree with much of what I read in the article, which I found hyperbolic and superficial. However, I also disagree with some of the responses. Critics have called for Gutierrez to be removed from her position. Gutierrez is advancing her intellectual view of the role and barriers of mathematics education in the United States. Her voice adds to the broader debate over the influence of privilege or race on subjects. One can disagree with those views while defending Gutierrez’ right to articulate and defend them.

Guiterrez has a stellar background that includes a Ph.D., in Curriculum and Instruction, from University of Chicago as well as an M.A. from Chicago and a B.A. in Human Biology from Stanford University. Her bio states that “Dr. Gutierrez’ scholarship focuses on equity issues in mathematics education, paying particular attention to how race, class, and language affect teaching and learning.”

In the end, it is a shame to see math treated as a field of privilege when many of us view it as a field of pure intellectual pursuit and bias neutrality. Either the math is there or it is not. The race of the mathematician will not change the outcome. Moreover, the way to fight any bias is to leave “political knowledge” outside of the classroom. Guiterrez has attracted some cache by calling for teachers to look beyond the numbers to find white privilege. Yet the danger is importing extrinsic influences into an area that is wonderfully self-contained and politically neutral. Indeed, many minorities sought math careers because it is a field premised on objective measurement. That is why I was left unconvinced by the earlier academic article. To use a valuable expression, “the numbers simply do not add up.”

-----------------------------------------

University of Illinois math professor Rochelle Gutierrez has triggered a national controversy over her recent anthology for math educators entitled, “Building Support for Scholarly Practices in Mathematics Methods.” Gutierrez suggests that mathematic tends to perpetuate white privilege that must be actively addressed in classrooms. For many, math is one subject that was viewed inherently objective and unbiased in its emphasis. Albert Einstein and others saw beauty in math. He stated “Pure mathematics is, in its way, the poetry of logical ideas.” Yet, Gutierrez appears to see the “politics that mathematics brings” and white privilege.

Gutierrez warns that “School mathematics curricula emphasizing terms like Pythagorean Theorem and pi perpetuate a perception that mathematics was largely developed by Greeks and other Europeans.” She adds “On many levels, mathematics itself operates as whiteness. Who gets credit for doing and developing mathematics, who is capable in mathematics, and who is seen as part of the mathematical community is generally viewed as white.”

Gutierrez raises these same views in her 2013 academic article entitled Why (Urban) Mathematics Teachers Need Political Knowledge in the Journal of Urban Mathematics Education. She wrote that “similar to whiteness, mathematics holds unearned privilege in society.” She emphasized that she was going beyond earlier writers who maintained that “mathematics education (emphasis added) operates as White institutional space. I am arguing that mathematics itself operates as whiteness.”

Gutierrez seeks to inject “political knowledge” into math classes to foster a “greater awareness of the unearned privilege that mathematics holds in society,.” She ties math to the ever-expanding notions of “microaggressions” and warns that many students “have experienced microaggressions from participating in math classrooms… [where people are] judged by whether they can reason abstractly.”

While I do not agree with much of what I read in the article, which I found hyperbolic and superficial. However, I also disagree with some of the responses. Critics have called for Gutierrez to be removed from her position. Gutierrez is advancing her intellectual view of the role and barriers of mathematics education in the United States. Her voice adds to the broader debate over the influence of privilege or race on subjects. One can disagree with those views while defending Gutierrez’ right to articulate and defend them.

Guiterrez has a stellar background that includes a Ph.D., in Curriculum and Instruction, from University of Chicago as well as an M.A. from Chicago and a B.A. in Human Biology from Stanford University. Her bio states that “Dr. Gutierrez’ scholarship focuses on equity issues in mathematics education, paying particular attention to how race, class, and language affect teaching and learning.”

In the end, it is a shame to see math treated as a field of privilege when many of us view it as a field of pure intellectual pursuit and bias neutrality. Either the math is there or it is not. The race of the mathematician will not change the outcome. Moreover, the way to fight any bias is to leave “political knowledge” outside of the classroom. Guiterrez has attracted some cache by calling for teachers to look beyond the numbers to find white privilege. Yet the danger is importing extrinsic influences into an area that is wonderfully self-contained and politically neutral. Indeed, many minorities sought math careers because it is a field premised on objective measurement. That is why I was left unconvinced by the earlier academic article. To use a valuable expression, “the numbers simply do not add up.”

The road to tyranny

The road to tyranny is a corrupt Department of Justice and corrupt Federal Bureau of Investigation. Once these are under political control, tyranny is relatively easy.

We are at risk.

We are at risk.

Tuesday, October 24, 2017

Transparent solar technology

Here is a link to an article about transparent solar technology, which has potential to obtain electric power from windows.

• Democrats are working to ensure Trump’s re-election

Here is a column by Jonathan Turley.

Trump vs. Clinton again? What entertainment!

You can't make this stuff up.

-----------------------------------------------

We have previously discussed how the Democratic establishment has held on to power despite the disaster in the last presidential election. The Democratic leadership and members were virtually unanimous in guaranteeing the nomination for Hillary Clinton despite the clear anti-establishment mood of the electorate and Clinton’s record negative polling. By the end of the campaign, the Democrats were largely arguing for an anti-Trump vote rather than a pro-Clinton vote. Despite the loss to the least popular presidential candidate in history, Nancy Pelosi and various other Democratic leaders have tightened their grip on power. The establishment then fought off a challenge from Bernie Sanders supporters and elected close Clinton ally Tom Perez to lead the Democratic National Committee. Now Perez has moved to fill high-ranking positions with establishment figures and Clinton allies. Among them is Donna Brazile who lied about her violation of DNC rules in sharing debate questions with Clinton. While the DNC staff rallied around Brazile, others saw Brazile as the very embodiment of the rigged primary and the hard-wired Clinton support in the media. Her unethical conduct led to the termination of her CNN contract, but Perez now wants her on the DNC rules committee.

At the ironically named “DNC Unity Commission” meeting in Las Vegas, Perez circulated his list of appointments and nominations to DNC positions, which was leaked to the media. Sanders people found themselves outside of high-ranking positions in favor of lobbyists and insiders associated with the establishment.

The appointment of Brazile will be particularly galling for many activists who view her as one of the architects of the election disaster — and someone who lied to the media in the wake of the scandal. It will be hard to show Sanders’ supporters that the party has changed when these same figures reassume control over key positions. Yet, as the DNC continues to struggle with failing contributions, they are doubling down on establishment. These figures have succeeded in deflecting criticism of their key role in electing Trump with the selection of the candidate with the least chance to defeat him in an anti-establishment election. It is precisely the tactics used so unsuccessfully in the election, Now, with the opposition to Trump growing, they are returning to their prior positions in the hopes that voters will focus on their hate for Trump as opposed for their disdain for the Democratic establishment.

The risk is considerable for the party. They seriously miscalculated with Clinton in the last election. While she received more votes that Trump, many felt that other candidates would have easily prevailed against him. For critics, this move will reaffirm the view that the party elites are primarily concerns with their insular interests and their own self-preservation and self=perpetuation.

Trump vs. Clinton again? What entertainment!

You can't make this stuff up.

-----------------------------------------------

We have previously discussed how the Democratic establishment has held on to power despite the disaster in the last presidential election. The Democratic leadership and members were virtually unanimous in guaranteeing the nomination for Hillary Clinton despite the clear anti-establishment mood of the electorate and Clinton’s record negative polling. By the end of the campaign, the Democrats were largely arguing for an anti-Trump vote rather than a pro-Clinton vote. Despite the loss to the least popular presidential candidate in history, Nancy Pelosi and various other Democratic leaders have tightened their grip on power. The establishment then fought off a challenge from Bernie Sanders supporters and elected close Clinton ally Tom Perez to lead the Democratic National Committee. Now Perez has moved to fill high-ranking positions with establishment figures and Clinton allies. Among them is Donna Brazile who lied about her violation of DNC rules in sharing debate questions with Clinton. While the DNC staff rallied around Brazile, others saw Brazile as the very embodiment of the rigged primary and the hard-wired Clinton support in the media. Her unethical conduct led to the termination of her CNN contract, but Perez now wants her on the DNC rules committee.

At the ironically named “DNC Unity Commission” meeting in Las Vegas, Perez circulated his list of appointments and nominations to DNC positions, which was leaked to the media. Sanders people found themselves outside of high-ranking positions in favor of lobbyists and insiders associated with the establishment.

The appointment of Brazile will be particularly galling for many activists who view her as one of the architects of the election disaster — and someone who lied to the media in the wake of the scandal. It will be hard to show Sanders’ supporters that the party has changed when these same figures reassume control over key positions. Yet, as the DNC continues to struggle with failing contributions, they are doubling down on establishment. These figures have succeeded in deflecting criticism of their key role in electing Trump with the selection of the candidate with the least chance to defeat him in an anti-establishment election. It is precisely the tactics used so unsuccessfully in the election, Now, with the opposition to Trump growing, they are returning to their prior positions in the hopes that voters will focus on their hate for Trump as opposed for their disdain for the Democratic establishment.

The risk is considerable for the party. They seriously miscalculated with Clinton in the last election. While she received more votes that Trump, many felt that other candidates would have easily prevailed against him. For critics, this move will reaffirm the view that the party elites are primarily concerns with their insular interests and their own self-preservation and self=perpetuation.

Sunday, October 22, 2017

In Too Deep

Here is a link to a video about one of the dangers of flying - the pilot and the weather.

In Too Deep

In Too Deep

Saturday, October 21, 2017

Renewable energy

According to Wikipedia, “Renewable energy is energy that is collected from renewable resources, which are naturally replenished on a human timescale, such as sunlight, wind, rain, tides, waves, and geothermal heat.”

It is hard to see why geothermal heat should be classified as renewable, since it is not replenished. In fact, sunlight, wind, tides, and waves stem from the sun’s energy, which also is not replenished. Yet these energy sources are useful, partly because they will be around for a long time.

Is the attractiveness of “renewable energy” based on whether they are truly renewable? Evidently not. And why the “replenished on a human timescale”?

Probably, the real reason why renewable energy is attractive is because it is not associated with greenhouse gas emissions, hence appeals to those concerned about climate.

If it is climate that is of concern, why not consider wood as a source of renewable energy? Growing a tree removes CO2 from the atmosphere. Burning the wood restores it. There is no net increase in CO2 over the grow-burn cycle. Sunlight drives this cycle. Wood is just as much renewable energy as “renewable energy”.

And to get back to the why the “replenished on a human timescale” issue – does it refer to a single human lifetime, several, or what? Why not focus on energy sources that do not increase CO2, net?

Fossil fuels are like wood, they are just as much renewable energy as all these other energy sources. The only difference is that you don’t burn the wood at once – you wait until it turns into coal or oil. Only the timescale is different. Fossil fuels represent just as much a zero net CO2 increase as “renewable energy” – the only difference being that their one-time cycle has not been completed. So, what’s the big deal about fossil fuels?

A little more careful thinking and less alarmism, please.

It is hard to see why geothermal heat should be classified as renewable, since it is not replenished. In fact, sunlight, wind, tides, and waves stem from the sun’s energy, which also is not replenished. Yet these energy sources are useful, partly because they will be around for a long time.

Is the attractiveness of “renewable energy” based on whether they are truly renewable? Evidently not. And why the “replenished on a human timescale”?

Probably, the real reason why renewable energy is attractive is because it is not associated with greenhouse gas emissions, hence appeals to those concerned about climate.

If it is climate that is of concern, why not consider wood as a source of renewable energy? Growing a tree removes CO2 from the atmosphere. Burning the wood restores it. There is no net increase in CO2 over the grow-burn cycle. Sunlight drives this cycle. Wood is just as much renewable energy as “renewable energy”.

And to get back to the why the “replenished on a human timescale” issue – does it refer to a single human lifetime, several, or what? Why not focus on energy sources that do not increase CO2, net?

Fossil fuels are like wood, they are just as much renewable energy as all these other energy sources. The only difference is that you don’t burn the wood at once – you wait until it turns into coal or oil. Only the timescale is different. Fossil fuels represent just as much a zero net CO2 increase as “renewable energy” – the only difference being that their one-time cycle has not been completed. So, what’s the big deal about fossil fuels?

A little more careful thinking and less alarmism, please.

Friday, October 20, 2017

Eyes on Voyager

To learn about the Voyager spacecraft and see videos of their flight path:

Go to this Eyes on Voyager

Click on "Download App"

Install the app.

Click on "Launch"

You will appreciate what humanity can accomplish, as opposed to the mess that politicians and the media create daily.

Go to this Eyes on Voyager

Click on "Download App"

Install the app.

Click on "Launch"

You will appreciate what humanity can accomplish, as opposed to the mess that politicians and the media create daily.

Proposed bump stock ban is really an opening to ban ordinary firearms

Here is John Lott on the proposed bump stock ban.

JL is on target. The anti-gun crowd is using the Las Vegas massacre as an opportunity to make it possible to ban ordinary semiautomatic rifles.

A law banning bump stocks will not accomplish that. It is easy to make one out of readily available materials. The proposed law would make it possible to ban a trigger, since (paraphrasing the proposed law) in combination with, for example, a bump stock, it is an integral part of a combination of parts designed to and functions to increase the rate of fire of a semiautomatic rifle but does not convert the semiautomatic rifle into a machinegun.

It is a mistake to ban parts of ordinary firearms simply because adding a bump stock or other external part can increase the rate of fire to that approximating an automatic weapon. Rather, it should be illegal to 1) convert in any manner a semiautomatic firearm so that it fires at a rate approximating an automatic firearm, and 2) banning only parts that do so that are not semiautomatic firearm parts. In other words, no parts should be banned that are semiautomatic firearm parts designed for semiautomatic operation.

Here is JL's comment.

-------------------------------------------

Sometimes in the rush “to do something” after a tragedy, politicians put forward bills that could easily cause more harm than good. The legislation being put forward to ban “bump stocks,” a firearm accessory that uses the recoil of the semi-automatic gun to fire more rapidly, might end up banning all semi-automatic guns. Take a bill in the House by Rep. Carlos Curbelo, a Florida Republican, which has 28 co-sponsors. The key part of this bill is that it bans “any part or combination of parts that is [SIC] designed and functions to increase the rate of fire of a semiautomatic rifle” and “any such part or combination of parts.” The bill is available below. The problem is that this reads so broadly that a semiautomatic gun has parts that when used in combination with a bump stock or other similar device that will increase the rate of fire of a rifle.

People have three types of guns

— Manually loaded guns. After firing a bullet, the shooter has to physically load the next bullet into the chamber of the gun.

— Semi-automatic. One pull of the trigger, one bullet fired, the gun reloads itself. One pull of the trigger, one bullet fired, and so on.

— Fully automatic. As long as the trigger is depressed, bullets will continue being fired. It isn’t necessary to pull the trigger a second time to fire another bullet.

If politicians actually want to ban all semi-automatic guns, they should be explicit and say so. But it would be a real problem for people who use guns in self-defense. Not everyone has time to manually reload their guns when confronted by criminals. If one’s first shot misses or there are multiple criminals, people may not have the time to manually reload their gun so that they have a second or third shot.

JL is on target. The anti-gun crowd is using the Las Vegas massacre as an opportunity to make it possible to ban ordinary semiautomatic rifles.

A law banning bump stocks will not accomplish that. It is easy to make one out of readily available materials. The proposed law would make it possible to ban a trigger, since (paraphrasing the proposed law) in combination with, for example, a bump stock, it is an integral part of a combination of parts designed to and functions to increase the rate of fire of a semiautomatic rifle but does not convert the semiautomatic rifle into a machinegun.

It is a mistake to ban parts of ordinary firearms simply because adding a bump stock or other external part can increase the rate of fire to that approximating an automatic weapon. Rather, it should be illegal to 1) convert in any manner a semiautomatic firearm so that it fires at a rate approximating an automatic firearm, and 2) banning only parts that do so that are not semiautomatic firearm parts. In other words, no parts should be banned that are semiautomatic firearm parts designed for semiautomatic operation.

Here is JL's comment.

-------------------------------------------

Sometimes in the rush “to do something” after a tragedy, politicians put forward bills that could easily cause more harm than good. The legislation being put forward to ban “bump stocks,” a firearm accessory that uses the recoil of the semi-automatic gun to fire more rapidly, might end up banning all semi-automatic guns. Take a bill in the House by Rep. Carlos Curbelo, a Florida Republican, which has 28 co-sponsors. The key part of this bill is that it bans “any part or combination of parts that is [SIC] designed and functions to increase the rate of fire of a semiautomatic rifle” and “any such part or combination of parts.” The bill is available below. The problem is that this reads so broadly that a semiautomatic gun has parts that when used in combination with a bump stock or other similar device that will increase the rate of fire of a rifle.

People have three types of guns

— Manually loaded guns. After firing a bullet, the shooter has to physically load the next bullet into the chamber of the gun.

— Semi-automatic. One pull of the trigger, one bullet fired, the gun reloads itself. One pull of the trigger, one bullet fired, and so on.

— Fully automatic. As long as the trigger is depressed, bullets will continue being fired. It isn’t necessary to pull the trigger a second time to fire another bullet.

If politicians actually want to ban all semi-automatic guns, they should be explicit and say so. But it would be a real problem for people who use guns in self-defense. Not everyone has time to manually reload their guns when confronted by criminals. If one’s first shot misses or there are multiple criminals, people may not have the time to manually reload their gun so that they have a second or third shot.

Thursday, October 19, 2017

The Curse of Good Intentions

Matt Ridley distinguishes between good intentions and results - not much correlation - and probably negative.

MR is on target.

------------------------------------

The curse of modern politics is an epidemic of good intentions and bad outcomes. Policy after policy is chosen and voted on according to whether it means well, not whether it works. And the most frustrated politicians are those who keep trying to sell policies based on their efficacy, rather than their motives. It used to be possible to approach politics as a conversation between adults, and argue for unfashionable but effective medicine. In the 140-character world this is tricky (I speak from experience).

The fact that it was Milton Friedman who said “one of the great mistakes is to judge policies and programmes by their intentions rather than their results” rather proves the point. He was one of the most successful of all economists in getting results in terms of raising living standards, yet is widely despised today by both the left and centre as evil because he did not bother to do much virtue signalling.

The commentator James Bartholomew popularised the term “virtue signalling” for those who posture empathetically but emptily. “Je suis Charlie” (but I won’t show cartoons of the prophet), “Refugees welcome” (but not in my home) or “Ban fossil fuels” (let’s not talk about my private jet). You see it everywhere. The policies unveiled at the Conservative Party conference show that the party is aware of this and (alas) embracing it. On student fees, housing costs and energy bills, the Tories proposed symbolic changes that would do nothing to solve the underlying problem, indeed might make them worse in some cases, but which at least showed they cared. I doubt it worked. They ended up sounding like pale imitations of Labour, or doing political dad-dancing.

“Our election campaign portrayed us as a party devoid of values,” said Robert Halfon MP in June.

“The Labour Party now has circa 700,000 members that want nothing from the Labour Party but views and values they agree with,” lamented Ben Harris-Quinney of the Bow Group last week. I think that what politicians mean by “values” is “intentions”.

The forgiving of good intentions lies behind the double standard by which we judge totalitarians. Whereas fascists are rightly condemned in schools, newspapers and social media as evil, communists get a much easier ride, despite killing more people. “For all its flaws, the Communist revolution taught Chinese women to dream big,” read a New York Times headline last month.

“For all its flaws, Nazi Germany did help bring Volkswagen and BMW to the car-buying public,” replied one wag on Twitter.

Imagine anybody getting away with saying of Mussolini or Franco what John McDonnell and Jeremy Corbyn said of Fidel Castro or Hugo Chávez. The reason for this double standard is the apparently good intentions of communist dictators: unlike Nazis, communists were at least trying to make a workers’ paradise; they just got it wrong. Again and again and again.

Though Jeremy Corbyn is a leading exponent, elevating intentions over outcomes is not entirely a monopoly of the left. It is something that the coalition government kept trying, in emulation of Tony Blair. Hugging huskies and gay marriage were pursued mainly for the signal they sent, rather than for the result they achieved. (Student loans, to be fair, were the opposite.) Indeed, George Osborne’s constant talk of austerity, while increasing spending in real terms, was an example of the gap between intention and outcome, albeit less sugar-coated.

I can draw up a list as long as your arm of issues where the road to failure is paved with counterproductive benevolence. Gordon Brown’s 50p top tax rate brought in less tax from the richest. Banning foxhunting has led to the killing of more foxes. Opposition to badger culls made no ecological sense, for cattle, hedgehogs, people — or badger health. Mandating a percentage of GDP for foreign aid was a virtuous gesture that causes real inefficiency and corruption — and (unlike private philanthropy) also tended to transfer money from poor people in rich countries to rich people in poor countries.

Or take organic farming, which has been shown repeatedly to produce trivial or zero health benefits, while any environmental benefits are grossly outweighed by the low yields that mean it requires taking more land from nature. Yet the BBC’s output on farming is dominated by coverage of the 2 per cent of farming that is organic, and is remorselessly obsequious. Why? Because organic farmers say they are trying to be nice to the planet.

My objection to wind farms is based on the outcome of the policy, whereas most people’s support is based largely on the intention. There they stand, 300ft tall, visibly advertising their virtue as signals of our commitment to devotion to Gaia. The fact that each one requires 150 tonnes of coal to make, that it needs fossil fuel back-up for when the wind is not blowing, that it is subsidised disproportionately by poor people and the rewards go disproportionately to rich people, and that its impact on emissions is so small as to be unmeasurable — none of these matter. It’s the thought that counts.

The Paris climate accord is one big virtue-signalling prayer, whose promises, if implemented, would make a difference in the temperature of the atmosphere in 2100 so small it is practically within the measuring error. But it’s the thought that counts. Donald Trump just does not care.

One politician who has always refused to play the intention game is Nigel Lawson. Rather than rest on the laurels of his political career, he has devoted his retirement to exposing the gap between rhetoric and reality in two great movements: European integration and climate change mitigation. In his book An Appeal to Reason, he pointed out that on the UN’s official forecasts, climate change, unchecked, would mean the average person will be 8.5 times as rich in 2100 as today, rather than 9.5 times if we stopped the warming. And to achieve this goal we are to punish the poor of today with painful policies? This isn’t “taking tough decisions”; this is prescribing chemotherapy for a cold.

Yet the truth is, Lord Lawson and I and others like us have so far largely lost the argument on climate change entirely on the grounds of intentions. Being against global warming is a way of saying you care about the future. Not being a headless chicken — however well argue your case — leads to accusations you do not care.

MR is on target.

------------------------------------

The curse of modern politics is an epidemic of good intentions and bad outcomes. Policy after policy is chosen and voted on according to whether it means well, not whether it works. And the most frustrated politicians are those who keep trying to sell policies based on their efficacy, rather than their motives. It used to be possible to approach politics as a conversation between adults, and argue for unfashionable but effective medicine. In the 140-character world this is tricky (I speak from experience).

The fact that it was Milton Friedman who said “one of the great mistakes is to judge policies and programmes by their intentions rather than their results” rather proves the point. He was one of the most successful of all economists in getting results in terms of raising living standards, yet is widely despised today by both the left and centre as evil because he did not bother to do much virtue signalling.

The commentator James Bartholomew popularised the term “virtue signalling” for those who posture empathetically but emptily. “Je suis Charlie” (but I won’t show cartoons of the prophet), “Refugees welcome” (but not in my home) or “Ban fossil fuels” (let’s not talk about my private jet). You see it everywhere. The policies unveiled at the Conservative Party conference show that the party is aware of this and (alas) embracing it. On student fees, housing costs and energy bills, the Tories proposed symbolic changes that would do nothing to solve the underlying problem, indeed might make them worse in some cases, but which at least showed they cared. I doubt it worked. They ended up sounding like pale imitations of Labour, or doing political dad-dancing.

“Our election campaign portrayed us as a party devoid of values,” said Robert Halfon MP in June.

“The Labour Party now has circa 700,000 members that want nothing from the Labour Party but views and values they agree with,” lamented Ben Harris-Quinney of the Bow Group last week. I think that what politicians mean by “values” is “intentions”.

The forgiving of good intentions lies behind the double standard by which we judge totalitarians. Whereas fascists are rightly condemned in schools, newspapers and social media as evil, communists get a much easier ride, despite killing more people. “For all its flaws, the Communist revolution taught Chinese women to dream big,” read a New York Times headline last month.

“For all its flaws, Nazi Germany did help bring Volkswagen and BMW to the car-buying public,” replied one wag on Twitter.

Imagine anybody getting away with saying of Mussolini or Franco what John McDonnell and Jeremy Corbyn said of Fidel Castro or Hugo Chávez. The reason for this double standard is the apparently good intentions of communist dictators: unlike Nazis, communists were at least trying to make a workers’ paradise; they just got it wrong. Again and again and again.

Though Jeremy Corbyn is a leading exponent, elevating intentions over outcomes is not entirely a monopoly of the left. It is something that the coalition government kept trying, in emulation of Tony Blair. Hugging huskies and gay marriage were pursued mainly for the signal they sent, rather than for the result they achieved. (Student loans, to be fair, were the opposite.) Indeed, George Osborne’s constant talk of austerity, while increasing spending in real terms, was an example of the gap between intention and outcome, albeit less sugar-coated.

I can draw up a list as long as your arm of issues where the road to failure is paved with counterproductive benevolence. Gordon Brown’s 50p top tax rate brought in less tax from the richest. Banning foxhunting has led to the killing of more foxes. Opposition to badger culls made no ecological sense, for cattle, hedgehogs, people — or badger health. Mandating a percentage of GDP for foreign aid was a virtuous gesture that causes real inefficiency and corruption — and (unlike private philanthropy) also tended to transfer money from poor people in rich countries to rich people in poor countries.

Or take organic farming, which has been shown repeatedly to produce trivial or zero health benefits, while any environmental benefits are grossly outweighed by the low yields that mean it requires taking more land from nature. Yet the BBC’s output on farming is dominated by coverage of the 2 per cent of farming that is organic, and is remorselessly obsequious. Why? Because organic farmers say they are trying to be nice to the planet.

My objection to wind farms is based on the outcome of the policy, whereas most people’s support is based largely on the intention. There they stand, 300ft tall, visibly advertising their virtue as signals of our commitment to devotion to Gaia. The fact that each one requires 150 tonnes of coal to make, that it needs fossil fuel back-up for when the wind is not blowing, that it is subsidised disproportionately by poor people and the rewards go disproportionately to rich people, and that its impact on emissions is so small as to be unmeasurable — none of these matter. It’s the thought that counts.

The Paris climate accord is one big virtue-signalling prayer, whose promises, if implemented, would make a difference in the temperature of the atmosphere in 2100 so small it is practically within the measuring error. But it’s the thought that counts. Donald Trump just does not care.

One politician who has always refused to play the intention game is Nigel Lawson. Rather than rest on the laurels of his political career, he has devoted his retirement to exposing the gap between rhetoric and reality in two great movements: European integration and climate change mitigation. In his book An Appeal to Reason, he pointed out that on the UN’s official forecasts, climate change, unchecked, would mean the average person will be 8.5 times as rich in 2100 as today, rather than 9.5 times if we stopped the warming. And to achieve this goal we are to punish the poor of today with painful policies? This isn’t “taking tough decisions”; this is prescribing chemotherapy for a cold.

Yet the truth is, Lord Lawson and I and others like us have so far largely lost the argument on climate change entirely on the grounds of intentions. Being against global warming is a way of saying you care about the future. Not being a headless chicken — however well argue your case — leads to accusations you do not care.

If turn about was fair play, we would muzzle the elites

Here is Jonathan Turley's comment on three academics' paper "Fool Me Once: The Case for Government Regulation of 'Fake News'."

JT is on target.

Don't let the Elites fool you. A Ph.D. doesn't imply that you

--------------------------------------------------------

In one of the most reckless and chilling attacks on free speech, the former chair of the Federal Election Commission (FEC) and Berkeley lecturer Ann Ravel is pushing for a federal crackdown on “disinformation” on the Internet — a term that she conspicuously fails to concretely define. Ravel is pushing a proposal that she laid out in a a paper co-author with Abby K. Wood, an associate professor at the University of Southern California, and Irina Dykhne, a student at USC Gould School of Law. To combat “fake news,” Ravel and her co-authors would undermine the use of the Internet as a forum for free speech. The regulation would include the targeting of people who share stories deemed fake or disinformation by government regulators. The irony is that such figures are decrying Russian interference with our system and responding by curtailing free speech — something Vladimir Putin would certainly applaud.

In addition to new rules on paid ads, Ravel wants fake news to be regulated under her proposal titled Fool Me Once: The Case for Government Regulation of ‘Fake News.” If adopted, a “social media user” would be flagged for sharing anything deemed false by regulators: