Joseph Stiglitz, like Paul Krugman, is a Nobel prize winning economist who has let his emotions overcome his intellect. Cochrane illustrates this in his article.

You cannot conclude credibility from the fact that someone has a Ph.D or even that they have won a Nobel prize.

------------------------------------------------------

So how is the economy doing? A good friend passed along for comment a recent project syndicate essay by Nobel Prize winning economist Joe Stiglitz. For an alternative view, I found interesting commentary on the CEA website, "The Impact of the Trump Labor market on historically disadvantaged Americans" and "The blue-collar boom reduces inequality"

A fact that cannot be missed is that overall GDP is growing. In terms of the overall economy, 2019 was the best year in all of human history. The 3.5% unemployment rate has not been this low since December 1969. So, if we wish to complain, it must be that this prosperity is not evenly shared. (I would also complain that things could be much better, but neither of our essays today is really about that point. Free-market paradise will have to wait.)

Stiglitz:

As the world’s business elites trek to Davos for their annual gathering, people should be asking a simple question: Have they overcome their infatuation with US President Donald Trump?

Two years ago, a few rare corporate leaders were concerned about climate change, or upset at Trump’s misogyny and bigotry. Most, however, were celebrating the president’s tax cuts for billionaires and corporations and looking forward to his efforts to deregulate the economy. That would allow businesses to pollute the air more, get more Americans hooked on opioids, entice more children to eat their diabetes-inducing foods, and engage in the sort of financial shenanigans that brought on the 2008 crisis.

Hmm. Before we get on to economics, let us parse that as rhetoric. In making any argument, one may try to convince the other side, one may to convince the great undecided middle, or one may try to rile up those already persuaded. If one wishes to convince the other side, or the middle, it is useful to start by reaching out -- I understand your worldview, we have common goals, we're all in this together, but here are some unsettling facts you should become aware of. One should work hard not to needlessly piss off a reader who starts on the other side of an argument. If you wish to convince me of Y, do not start by stating as fact an opinion about Z which I heartily disagree with, which is irrelevant to Y. Gain trust, do not squander it. Do not needlessly personalize, politicize, or demonize the argument. Don't assert evil motives, at least without evidence, and especially of those you wish to convince.

Well, it's pretty clear which strategy Stiglitz is following here! Before we get to any economics, it starts with Trump, and "infatuation." That corporate leaders are "infatuated" with Trump, and that few corporate leaders were concerned about climate change 2 years ago is a simple falsehood. Corporate leaders are cloyingly woke. Jamie Diamond of JP Morgan Chase, leading the business roundtable, announced in favor of "stakeholders" not shareholders. Goldman Sachs itself just announced it won't fund oil and gas in the Arctic, or US companies that don't have female or "diverse" boards. Oil companies tout their commitment to climate. "Trump's mysogyny and bigotry?" Well, if you are at all a Trump fan, by insulting your guy, it's clear at the outset this article is not for you. Stiglitz seems in full Trump derangement syndrome, and leads a reader to suspect what follows may not be totally balanced.

"Most, however, were celebrating the president’s tax cuts for billionaires and corporations." Z again. asserted as fact, and motivation. What if I think that cutting marginal rates was a good thing -- after all the Obama administration wanted to cut corporate taxes for years? What about the plain fact that those advancing tax cuts did not say "we want to give tax cuts for billionaires and corporations." They explained traditional economics that they wanted a greater incentive to invest, which would raise the capital stock which in time would raise wages. They were celebrating, in their words, Trump's growth-enhancing marginal rate reductions. You may think otherwise of the effect, but adding calumny and vilification to statements asserted as facts that half your readers disagree with is a sure way to cut out all but your base.

The reader must also, before proceeding to the argument, accept as common ground fact that anyone who thinks a bit of regulatory reform may be useful for the economy (me) has as their motivation a desire to "pollute the air more, get more Americans hooked on opioids, entice more children to eat their diabetes-inducing foods." I haven't been to Davos, but I wonder just how many cocktail parties there are where people debate, say "how do we get some more pollution up, and fatten the little children more?" Is that one next to the satanic rituals? Does Davos have no cocktail parties bemoaning climate change?

(I went on a bit here, as I have listened to quite a bit of the Democratic House manager's presentations to the Senate in the last few days. Are they trying to convince Republicans to vote their way, or are they playing to rile up a base in the next election? You choose.)

Well, let's read on, though we are clearly not invited here. What is the case? GDP is up, employment is up, wages are up especially among people of limited means. Where is the economic tragedy?

"US life expectancy, already relatively low, fell in each of the first two years of Trump’s presidency, and in 2017, midlife mortality reached its highest rate since World War II. This is not a surprise, because no president has worked harder to make sure that more Americans lack health insurance."

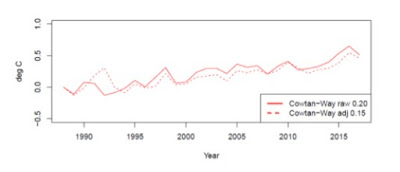

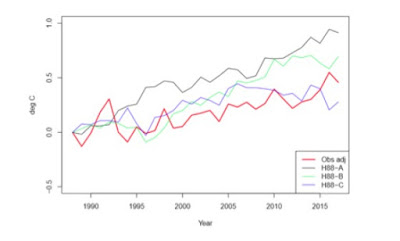

Stiglitz doesn't give a source. I found one at the world bank, and echoed at Fred

Hmm. Before we get on to economics, let us parse that as rhetoric. In making any argument, one may try to convince the other side, one may to convince the great undecided middle, or one may try to rile up those already persuaded. If one wishes to convince the other side, or the middle, it is useful to start by reaching out -- I understand your worldview, we have common goals, we're all in this together, but here are some unsettling facts you should become aware of. One should work hard not to needlessly piss off a reader who starts on the other side of an argument. If you wish to convince me of Y, do not start by stating as fact an opinion about Z which I heartily disagree with, which is irrelevant to Y. Gain trust, do not squander it. Do not needlessly personalize, politicize, or demonize the argument. Don't assert evil motives, at least without evidence, and especially of those you wish to convince.

Well, it's pretty clear which strategy Stiglitz is following here! Before we get to any economics, it starts with Trump, and "infatuation." That corporate leaders are "infatuated" with Trump, and that few corporate leaders were concerned about climate change 2 years ago is a simple falsehood. Corporate leaders are cloyingly woke. Jamie Diamond of JP Morgan Chase, leading the business roundtable, announced in favor of "stakeholders" not shareholders. Goldman Sachs itself just announced it won't fund oil and gas in the Arctic, or US companies that don't have female or "diverse" boards. Oil companies tout their commitment to climate. "Trump's mysogyny and bigotry?" Well, if you are at all a Trump fan, by insulting your guy, it's clear at the outset this article is not for you. Stiglitz seems in full Trump derangement syndrome, and leads a reader to suspect what follows may not be totally balanced.

"Most, however, were celebrating the president’s tax cuts for billionaires and corporations." Z again. asserted as fact, and motivation. What if I think that cutting marginal rates was a good thing -- after all the Obama administration wanted to cut corporate taxes for years? What about the plain fact that those advancing tax cuts did not say "we want to give tax cuts for billionaires and corporations." They explained traditional economics that they wanted a greater incentive to invest, which would raise the capital stock which in time would raise wages. They were celebrating, in their words, Trump's growth-enhancing marginal rate reductions. You may think otherwise of the effect, but adding calumny and vilification to statements asserted as facts that half your readers disagree with is a sure way to cut out all but your base.

The reader must also, before proceeding to the argument, accept as common ground fact that anyone who thinks a bit of regulatory reform may be useful for the economy (me) has as their motivation a desire to "pollute the air more, get more Americans hooked on opioids, entice more children to eat their diabetes-inducing foods." I haven't been to Davos, but I wonder just how many cocktail parties there are where people debate, say "how do we get some more pollution up, and fatten the little children more?" Is that one next to the satanic rituals? Does Davos have no cocktail parties bemoaning climate change?

(I went on a bit here, as I have listened to quite a bit of the Democratic House manager's presentations to the Senate in the last few days. Are they trying to convince Republicans to vote their way, or are they playing to rile up a base in the next election? You choose.)

Well, let's read on, though we are clearly not invited here. What is the case? GDP is up, employment is up, wages are up especially among people of limited means. Where is the economic tragedy?

"US life expectancy, already relatively low, fell in each of the first two years of Trump’s presidency, and in 2017, midlife mortality reached its highest rate since World War II. This is not a surprise, because no president has worked harder to make sure that more Americans lack health insurance."

Stiglitz doesn't give a source. I found one at the world bank, and echoed at Fred

2014: 78.84

2015: 78.69 (-0.15)

2016: 78.54 (-0.15)

2017: 78.54 (0.00)

Hmm. Who was in office in 2015 and 2016?

Anyway, this is a grand calumny. Yes, it is troubling to see life expectancy decline, and troubling that ours is less than some other countries. But the reasons are clear and well known. The US starts with much worse demographics. Scandinavia has longer life expectancy, but so does Minnesota. The main issues in these statistics are gunshot wounds, mostly from gang warfare and suicide, traffic accidents, and drug overdoses. Not health insurance.

That the decline in life expectancy -- and the immense health problems of poorer parts of the country -- have anything to do with President Trump working hard "to make sure that more Americans lack health insurance" is just ludicrous. Trump does a lot of zany things, but I doubt even Adam Schiff could find a meeting where Trump gets his advisers together to work on "what can we do to make sure some more Americans lack health insurance?" Is this before or after the satanic rituals? The many studies of health insurance don't find much of any correlation with life expectancy. Less stress about medical bills yes.

In fact, Stiglitz goes on to contradict himself.

One reason for declining life expectancy in America is what Anne Case and Nobel laureate economist Angus Deaton call deaths of despair, caused by alcohol, drug overdoses, and suicide. In 2017 (the most recent year for which good data are available), such deaths stood at almost four times their 1999 level. Indeed. And this did not start November 6 2016, nor does it have anything to do with health insurance.

On to money

there was no significant change in the median US household’s disposable income between 2017 and 2018 ...The lion’s share of the increase in GDP is also going to those at the top. Real median weekly earnings are just 2.6% above their level when Trump took office.

Well, "just" 2.6% ain't nothing. And actually there is good news here. John Grigsby has a very nice paper I saw last week pointing out that wages rose in the Great Recession. Why? Well all the low-wage people got fired, so the average wages of those remaining got hired. Right now, we are seeing some of the opposite. People who have been out of the labor force for years are returning. Even ex-cons are getting jobs. Employers are skipping the drugs tests. Hire a lot of people at less than average wages, and average wages go down. It is possible for every individual to get a raise but the average decline.

I'll come back to the economic fortunes of people at the margins in a second, with the CEA's report. Let's finish Stiglitz' doom and gloom.

"Making matters worse, the growth that has occurred is not environmentally sustainable – and even less so thanks to the Trump administration’s gutting of regulations. The air will be less breathable, the water less drinkable, and the planet more subject to climate change. In fact, losses related to climate change have already reached new highs in the US, "

I'll come back to the economic fortunes of people at the margins in a second, with the CEA's report. Let's finish Stiglitz' doom and gloom.

"Making matters worse, the growth that has occurred is not environmentally sustainable – and even less so thanks to the Trump administration’s gutting of regulations. The air will be less breathable, the water less drinkable, and the planet more subject to climate change. In fact, losses related to climate change have already reached new highs in the US, "

Oh please. In two years? Just how much extra losses has the US suffered because of extra CO2 emitted by the US, and as a result of any Trump deregulatory action? 0.0000000...1? Actually, fracking has led to a natural gas boom which has lowered US emissions more than any other advanced country, no thanks to the Obama era EPA or the states that ban fracking or the candidates that propose to ban it. And has not Tesla grown a lot in the last two years? Where is any evidence that the last two years' growth is any less "sustainable" than before? What does that even mean, other than nasty Trump pulled out of the symbolic Paris accord and won't say nice things about climate? What does that mean to our worker on the low end of the scale, who we were supposed to be worrying about here?

"The tax cuts were supposed to spur a new wave of investment. Instead, they triggered an all-time record binge of share buybacks – some $800 billion in 2018 – by some of America’s most profitable companies,"

"The tax cuts were supposed to spur a new wave of investment. Instead, they triggered an all-time record binge of share buybacks – some $800 billion in 2018 – by some of America’s most profitable companies,"

That a Nobel Prize winner in economics can spew such obvious nonsense reveals... well, that he's passing on politician's talking points, not economics. (Posts on buybacks here here here) The economy's choice of investment vs. consumption has nothing to do with corporations' decision to buy back shares, pay dividends, buy another company, or invest. If a company buys back shares or pays out a big dividend, that means the company doesn't have any good investment projects. The investors then decide whether to give the money to another company that does have some ideas and is borrowing or issuing shares, or to splurge it on, say a private-jet trip to Davos and some carbon offsets. The overall level of investment depends on their actions, not the repurchase decision. Repurchases were in fact a great reform of a previous era, to empower stockholders to stop companies from "investing" retained earnings in pointless management-aggrandizing projects.

"Likewise, Trump’s trade wars, for all their sound and fury, have not reduced the US trade deficit,"

"Likewise, Trump’s trade wars, for all their sound and fury, have not reduced the US trade deficit,"

Well, finally something sensible. I'd go on -- basic economics says the bilateral trade deficit is totally meaningless anyway. Stiglitz seems to be signing on to the opposite, maybe because Democrats are basically with Trump on mercantilism and protection.

Even judging by GDP, the Trump economy falls short. Last quarter’s growth was just 2.1%, far less than the 4%, 5%, or even 6% Trump promised to deliver, and even less than the 2.4% average of Obama’s second term.

Even judging by GDP, the Trump economy falls short. Last quarter’s growth was just 2.1%, far less than the 4%, 5%, or even 6% Trump promised to deliver, and even less than the 2.4% average of Obama’s second term.

I think Obama may have promised a bit better than came true under his watch as well. Comparing one quarter to an 8 year average is an obvious sleight of hand.

And we left behind the supposed despair of the working classes.

Look, you may dislike Trump. You may object to personal style. You may object to trade and foreign policy. You may claim that the economy doesn't have that much to do with a president and deregulation and tax cuts. You may point out how much better things could be. But the claim that things have gotten dramatically worse for those on the bottom end of America's economy; that they were doing great under Obama and fell catastrophically under, or as any result of the actions of this one man, just won't hold. Yes, this is a narrative that some Democratic presidential candidates want to push. Sorry, the Great Depression ended in 1939.

************

And we left behind the supposed despair of the working classes.

Look, you may dislike Trump. You may object to personal style. You may object to trade and foreign policy. You may claim that the economy doesn't have that much to do with a president and deregulation and tax cuts. You may point out how much better things could be. But the claim that things have gotten dramatically worse for those on the bottom end of America's economy; that they were doing great under Obama and fell catastrophically under, or as any result of the actions of this one man, just won't hold. Yes, this is a narrative that some Democratic presidential candidates want to push. Sorry, the Great Depression ended in 1939.

************

The CEA reports paint a different picture. On rhetoric, there is a bit more Trump adulation than I'd like, which I think reduces its appeal to the middle and opposite side, just as Stiglitz' Trump vilification turns me off. But the boss pays the bills.

Annual nominal wage growth reached 3 percent in 2019 for the first time since the Great Recession,

This is about the same number as Stiglitz' 2.6% real in two years! This highlights an important point -- I do not see anyone contradicting each other on numbers. Which numbers one looks at, and which insults one hurls (sorry, which causal and motive attributions one makes) seem to be the difference.

More importantly, to the topic -- is growth spreading more or less equally?

wage growth for many historically disadvantaged groups is now higher than wage growth for more advantaged groups, as is the case for lower-income workers compared with higher- income ones, for workers compared with managers, and for African Americans compared with whites.

When measured as the share of income held by the top 20 percent, income inequality fell in 2018 by the largest amount in over a decade

Employment and earnings gains continue pulling people out of poverty and means-tested welfare programs... The number of people living in poverty decreased by 1.4 million from 2017 to 2018, and the poverty rates for blacks and Hispanics reached record lows..

And the lowest wage earners have seen the fastest nominal wage growth (10.6 percent) of any income group since the Tax Cuts and Jobs Act was signed into law. Beyond this pay increase for low-income workers, from the start of the current expansion to December 2016, average wage growth for workers lagged that for managers, and that for African Americans lagged that for white Americans. Since President Trump took office, each of these trends has been reversed, contributing to reduced income inequality.

These employment and income gains have brought people from the sidelines into employment. In the third quarter of 2019, 73.7 percent of workers entering employment came from out of the labor force rather than from unemployment, which is the highest share since the series began in 1990....

These employment and income gains have brought people from the sidelines into employment. In the third quarter of 2019, 73.7 percent of workers entering employment came from out of the labor force rather than from unemployment, which is the highest share since the series began in 1990....

a strong market for jobs creates work opportunities for those with less education or training, prior criminal convictions, or a disability.

Yes, you can argue that it's just a continuation of the previous trend. The CEA would point out that every forecast thought it had to stop, but forecasts have persistently been wrong. But doom and gloom and death and despair is hard to argue.

In September 2019, the unemployment rate for individuals without a high school degree fell to 4.8 percent, achieving a series low (the series began in 1992)

In September 2019, the unemployment rate for persons with a disability dropped to 6.1 percent, the lowest it has been since the series began in 2008.

Now, unemployment rates are not everything. What really matters is the number of people working, and people who aren't even looking are and remain a proble3m.

Although job growth remains robust and the unemployment rate is near a record low, the labor force participation rate has not recovered to its prerecession level.

Although job growth remains robust and the unemployment rate is near a record low, the labor force participation rate has not recovered to its prerecession level.

Stiglitz complained about this. But people in the US are getting older, which skews the numbers towards more people staying out of the labor force.

To find this adjusted rate, the age and sex distribution of the population is first held fixed at a given reference period. The demographically adjusted participation rate for each period is constructed by using that period’s age- and gender-specific participation rates and the population of the reference period.8

The bottom 10 percent wages are going up more than the rest! Now, one may say it's still not enough. The bottom 10 percent have pretty rotten lives, and pretty rotten jobs. But one cannot say it's getting worse.

Minorities are experiencing some of the fastest increases in pay. In 2019:Q3, African Americans saw their weekly earnings grow by 6.0 percent over the year, while Hispanics’ weekly earnings grew by 4.2 percent. For comparison, the 12-month change in weekly earnings for all Americans rose by 3.6 percent.

The (somewhat artificial) poverty line:

In 2018, the official poverty rate fell by 0.5 percentage point, to 11.8 percent, the lowest level since 2001,

In 2018, the official poverty rate fell by 0.5 percentage point, to 11.8 percent, the lowest level since 2001,

Disadvantaged groups experienced the largest poverty reductions in 2018. The poverty rate fell by 0.9 percentage point for black Americans and by 0.8 percentage point for Hispanic Americans, with both groups reaching historic lows (see figure 9). The poverty rates for black and Hispanic Americans in 2018 were never closer to the overall poverty rate in the United States. Children fared especially well in 2018, with a decrease in poverty of 1.2 percentage points for those under 18. Poverty among single mothers with children fell by 2.5 percentage points.

Again, poverty is not fun, and 11.8 percent is more than one would like. But one cannot say it's getting worse.

And they are not done. Among a smorgasbord of proposals, I liked this one

Occupational licensing requirements impose an additional cost on entering a given occupation. There is a wide range of licensed occupations, including plumbers, electricians, florists, and barbers (Meyer 2017). Some occupational licensing restrictions can be justified to protect the public, but the existing requirements for many occupations in many States include jobs that pose no physical or financial risk to the public. Instead, licensing is being used as a barrier to entry into a profession to artificially inflate wages for those already in the profession.

And they are not done. Among a smorgasbord of proposals, I liked this one

Occupational licensing requirements impose an additional cost on entering a given occupation. There is a wide range of licensed occupations, including plumbers, electricians, florists, and barbers (Meyer 2017). Some occupational licensing restrictions can be justified to protect the public, but the existing requirements for many occupations in many States include jobs that pose no physical or financial risk to the public. Instead, licensing is being used as a barrier to entry into a profession to artificially inflate wages for those already in the profession.

I like it especially because the Obama CEA made a big fuss about this. Here's something we can agree on!

Expanding Opportunities for Ex-Offenders

Expanding Opportunities for Ex-Offenders

Where is Stiglitz cheering?

Since the start of the Trump Administration, supporting working families has been a top priority. In December 2017, the President signed into law the Tax Cuts and Jobs Act, which increased the reward for working by doubling the Child Tax Credit and increasing its refundability. The President signed into law the largest-ever increase in funding for the Child Care and Development Block Grants—expanding access to high-quality child care for nearly 800,000 families across the country. In addition, President Trump was the first president to include nationwide paid parental leave in his annual budget.

Since the start of the Trump Administration, supporting working families has been a top priority. In December 2017, the President signed into law the Tax Cuts and Jobs Act, which increased the reward for working by doubling the Child Tax Credit and increasing its refundability. The President signed into law the largest-ever increase in funding for the Child Care and Development Block Grants—expanding access to high-quality child care for nearly 800,000 families across the country. In addition, President Trump was the first president to include nationwide paid parental leave in his annual budget.

Wait I thought that was a tax cut for billionaires. I think this stuff is nutty, but where is Stiglitz cheering?

Opioid deaths

Last year, Congress passed and President Trump signed the SUPPORT Act. The Administration secured $6 billion in new funding in fiscal years 2018 and 2019 to fight opioid abuse and to expand access to medication-assisted treatment. Improved border enforcement may also be reducing the supply of fentanyl; fentanyl seizures by Customs and Border Protection are up 265 percent over the last three fiscal years.

Wait, didn't Stiglitz blame Trump for opioids? Yes, there is a long way to go here, but accusing Trump and co of wanting to "get more Americans hooked" is just not true.

Turning to the "The blue-collar boom reduces inequality"

Net worth held by the bottom 50 percent of households has increased by 47 percent, more than three times the rate of increase for the top 1 percent of households.

I don't personalize things. I don't think Trump had this in mind. He wanted tariffs to bring back manufacturing jobs which they did not do. He did not campaign on "we're going to cut taxes, deregulate, the economy is going to boom, and all the low income low skill people will get jobs." But that is what is happening.

Of course the CEA also jumps quickly to causal conclusions

Contrary to the narrative that the Trump economy only benefits the top, these facts confirm the United States’ unprecedented blue-collar boom. Increased wealth for the bottom half of American households, faster wage growth for historically disadvantaged Americans, and falling welfare enrollment as incomes rise and people come off the labor market’s sidelines—these are the results of President Trump’s pro-growth, pro-worker policies.

I think we can regard this as at least debatable -- how much is because, how much is despite. That would be an interesting debate with a good left-wing economist. But gloom and doom is simply not true.